capital gains tax news canada

In Canada capital gains tax is applied to 50 of the profit you made. This would bring her to a taxable income of 33500.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

In other words if you sell an investment at a higher price than you paid realized.

. As of 2022 it stands at 50. The much more common way is through capital gains taxes. Taxing capital gains on home sales makes excellent sense.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. A 1031 tax deferred exchange which allows an heir.

In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on half. If the heir owns the property for more than a year he or she will be taxed at 0 15 or 20 on the long-term capital gains.

In Canada the capital gains inclusion rate is 50. But broader reform should be essential. You owe capital gains taxes on the profit that you make whenever you sell an investment asset or.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. The inclusion rate is the percentage of your gains that are subject to tax. The first way to avoid paying capital gains tax on rental property in Canada is to defer the sale of your property to a later date.

Olivia is in the. On February 4 2022 Finance Canada released proposed mandatory disclosure rules which would require more detailed reporting of certain transactions. This can be done using Section 1031 of the tax.

Since the inclusion rate is 50 her taxable capital gain is 3500. Written By Helen Burnett-Nichols What are capital gains. Combined with a 38-per-cent surtax on investment income adopted in 2010 to help fund Barack Obamas health care law the Biden reforms would raise the top tax rate on.

The inclusion rate has varied over time see graph below. Capital gains tax in Canada In Canada 50 of the value of any capital gains is taxable. In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income.

A capital gain is any profit made from the sale. On June 18 1987 Finance Minister Michael Wilson announced that the rate would increase to 6623. Canadians pay a 50 tax on all of their.

Do not include any capital gains or losses in your business or property income even if you. Congratulations now that you have earned a profit on your investment report it on your tax return because it is a taxable capital gain. The 50 percent inclusion rate remained in place until the late 1980s.

Olivias total capital gain is 7000. Different types of realized capital gains are taxed by. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Capital gains should be taxed on a blanket basis and evenly with income. On the flip side an.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Capital Gains And Tax Rates 2022

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax Hike Would Be Disastrous For Economic Recovery Fraser Institute

Biden S Capital Gains Tax Plan Would Upend Estate Planning By The Wealthy Wsj

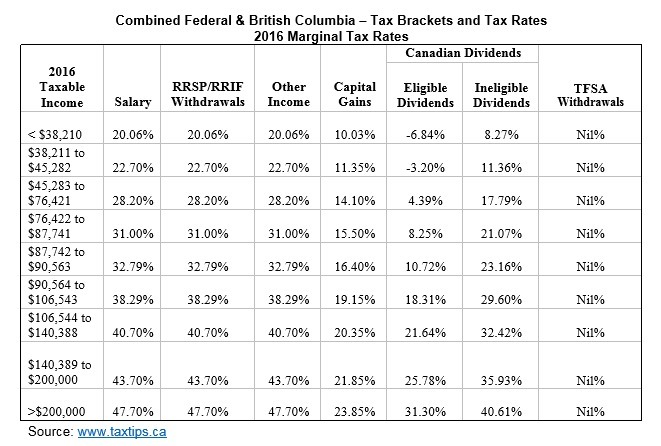

2016 Federal Budget Commentary Pacific Spirit Vancouver Financial Advisors Wealth Management

Finance Minister Doesn T Rule Out Future Changes To Capital Gains Taxes Cbc News

Political Suicide Capital Gains Tax On Home Sales A Risky Proposal Experts Say National Globalnews Ca

Capital Gains Tax Hike Could Reduce Extreme Wealth Gap In Canada Report Says Georgia Straight Vancouver S News Entertainment Weekly

Taxation Of Investment Income Within A Corporation Manulife Investment Management

How To Know If You Have To Pay Capital Gains Tax Experian

Canada Crypto Tax Guide 2022 Crypto News

:format(webp)/https://www.thestar.com/content/dam/thestar/business/opinion/2022/02/26/the-50-per-cent-inclusion-rate-on-capital-gains-benefits-mostly-the-rich-its-time-to-bump-it-up/capital_gains_tax.jpg)

The 50 Per Cent Inclusion Rate On Capital Gains Benefits Mostly The Rich It S Time To Bump It Up The Star

Capital Gains Tax Break Becomes Part Of A Double Whammy When Home Prices Fall Don Pittis Cbc News

Jonathan Garbutt Talks Capital Gains Taxes In Canada With Shiraz Ahmed On The Quarantine Broadcast Andersen

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)