south dakota property tax exemption

Dakota Constitution that provide property tax exemptions. Then the property is equalized to 85 for property tax purposes.

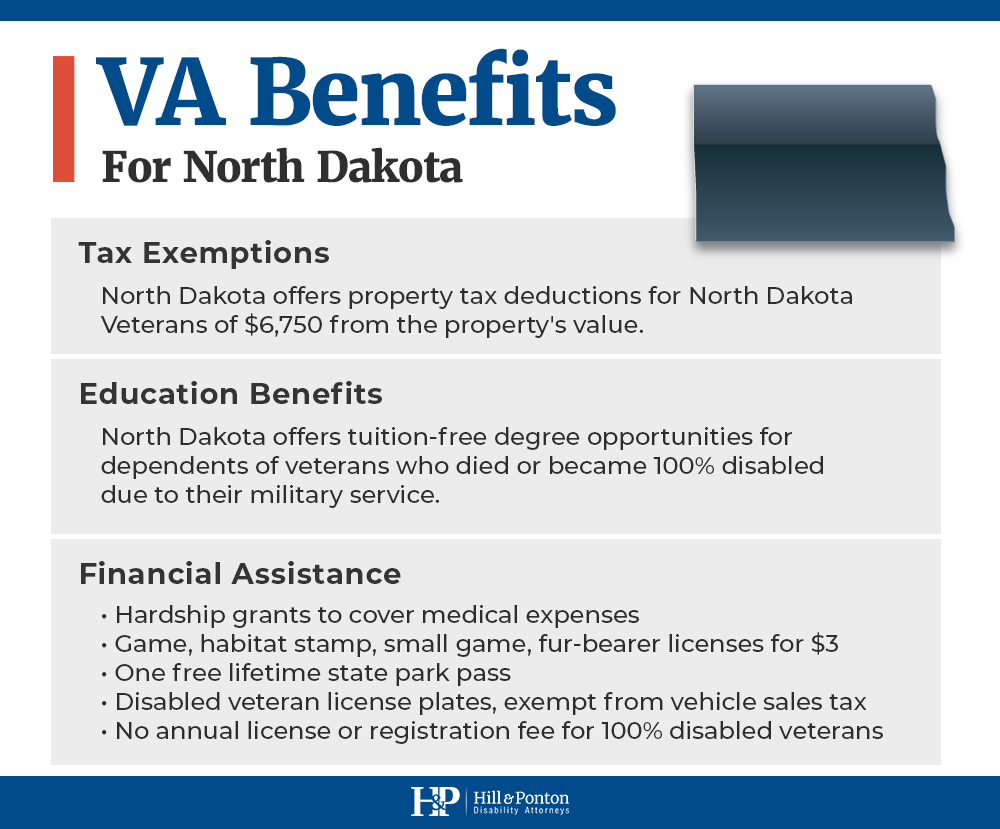

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

The Equalization Department is also responsible for administering various tax reduction or tax exemptions specified in.

. All applicants must provide proof of their eligibility for this. Signature will be applied to the page. The primary and main use of the land must be devoted to agricultural pursuits such as the harvesting of crops or the.

Please fill in your name and email and then either draw or type your signature below. You will have a chance to. Not exempt Minnesota motels and hotels are not exempt North Dakota Ohio and West Virginia.

The states laws must be adhered to in the citys handling of taxation. Exempts up to 150000 of the assessed value for qualifying property. The governments from states without a sales tax are exempt from South Dakota sales.

The property subject to this exemption is the same property eligible for the owner-occupied classification To be. For land to be classified as agricultural it must meet the following criteria. Is the above described property classified in the county director of equalization office as owner-occupied.

Property Tax Exemption for Veterans and their Widow or Widower. South Dakota property tax credit. Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes.

Property other than computer software. South Dakota Property Tax Exemptions for Energy South Dakota offers property tax exemptions for installed solar systems. South Dakota offers a partial property tax exemption up to 150000 for disabled Veterans and their Surviving Spouse.

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. Resale or Re-lease South Dakota. Property tax exemptions allow businesses and homeowners to.

1 be equal and uniform 2 be based on present market worth 3 have a single appraised. South Dakota Property Tax Exemption for Disabled Veterans. Create Your Signature.

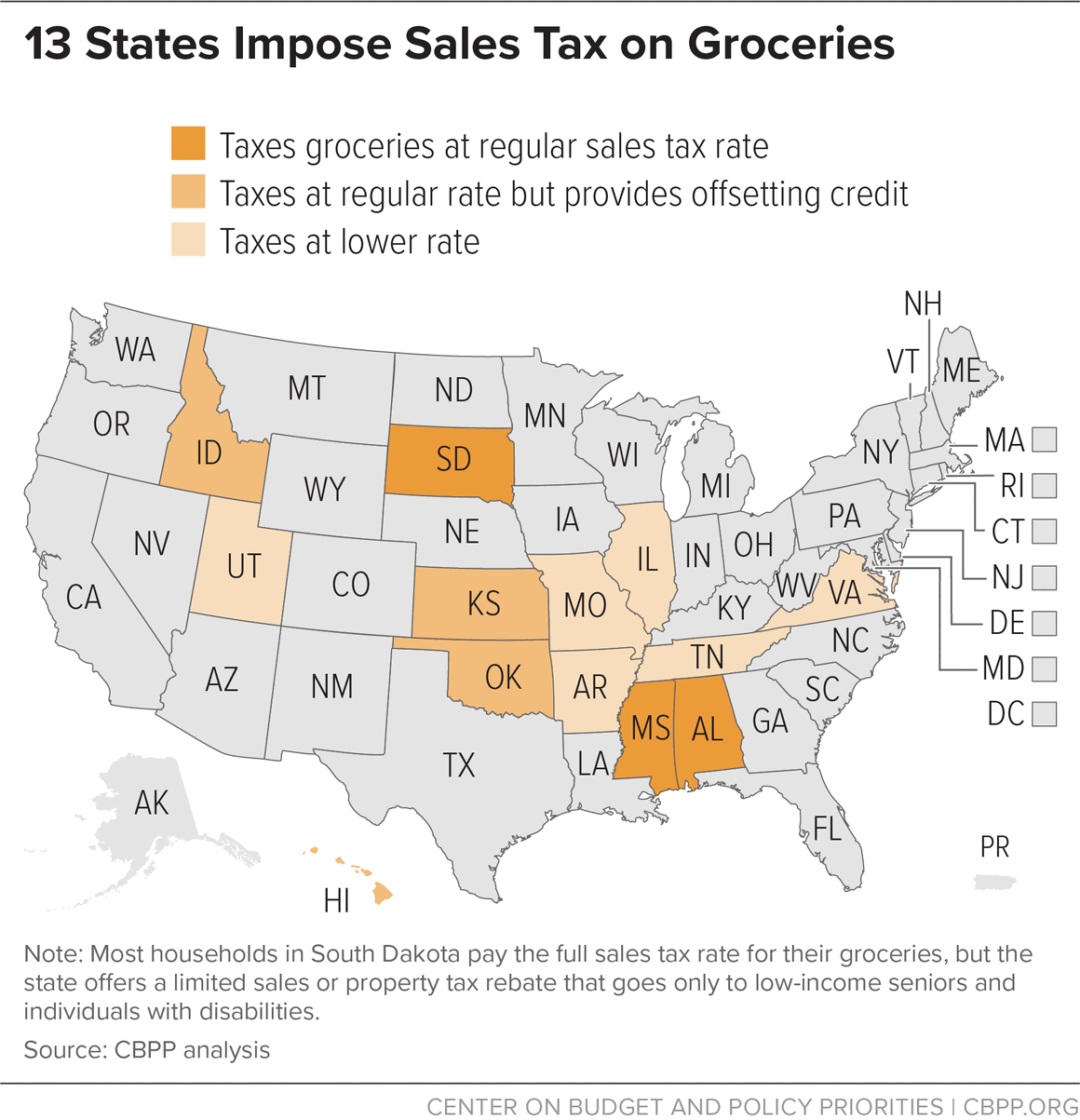

Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Equalization Department - Property Tax Reductions Exemptions.

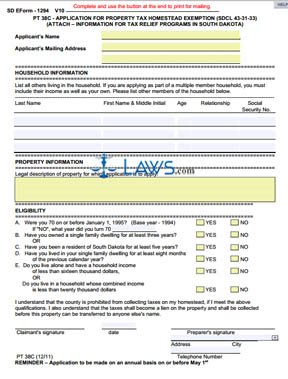

Are NOT exempt from South Dakota sales or use tax. Taxation of properties must. South Dakota Property Tax Exemption South Dakota state law SDCL 10-4-44.

Beginning in 2021 biomass fuel stoves are also included in tax credits for residential renewable energy products. SDCL 10-4-2410 states that dwellings or parts of multiple family dwellings which are specifically designed for use by. You do not fraudulently fail to collect the tax due.

South Dakotas median income is 56323 per year so the median yearly property tax paid by South Dakota residents amounts to approximately of their yearly income. The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax.

.png)

Farm Residence Exemption Morton County North Dakota

Free Form Pt 38c Application For Property Tax Homestead Exemption Free Legal Forms Laws Com

Property Tax Calculator Estimator For Real Estate And Homes

South Dakota Military And Veterans Benefits The Official Army Benefits Website

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Best Worst State Property Tax Codes Tax Foundation

2022 Property Taxes By State Report Propertyshark

Disabled Veterans Property Tax Exemptions By State

Property Tax South Dakota Department Of Revenue

Are There Any States With No Property Tax In 2022 Free Investor Guide

Property Tax South Dakota Department Of Revenue

How The House Tax Proposal Would Affect South Dakota Residents Federal Taxes Itep

Real Property Tax Exemption Information And Forms Town Of Perinton

Historical South Dakota Tax Policy Information Ballotpedia

Longtime Sd Resident Homeowners Would See Property Tax Relief Under Bill

Relief Programs South Dakota Department Of Revenue